-

Welcome new G&W UK/Europe CEO, Tim Shoveller

-

Freightliner is voted Rail Freight Company of the Year at the 2023 Multimodal Awards

-

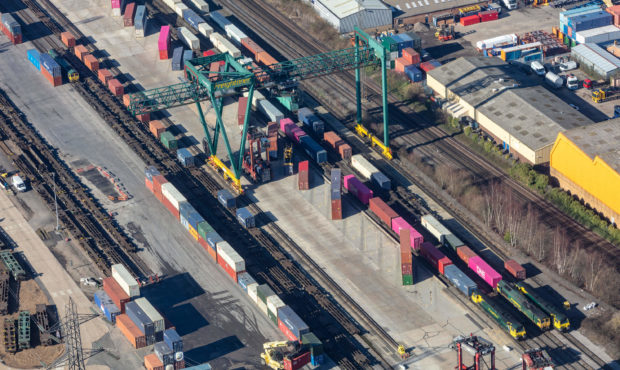

Ahead of Multimodal 2023 in Birmingham, Freightliner, the largest intermodal rail logistics operator in the UK, is pleased to confirm its support for DP World’s Modal Shift Programme, which is to commence in September 2023.

-

Freightliner opens Ipswich Operational Training Academy

-

Genesee & Wyoming Appoints Tim Shoveller as CEO of UK/Europe Operations

-

Long-term partners Freightliner, a subsidiary of Genesee & Wyoming Inc. (G&W), and Ocean Network Express (ONE) have agreed to realise their commitment towards a greener future launching their first-ever rail solution supported by GD+ fuel in the United Kingdom.

-

Freightliner Co-sponsors New Children’s Book Raising Awareness of Diversity and Inclusion in the Rail Industry

-

Freightliner is voted Rail Freight Operator of the Year at the 2022 Multimodal Awards

-

Phase 3 expansion at Pentalver’s London Gateway Terminal completed

-

Freightliner and East Midland Railway collaborate to run new service from Cleethorpes to Barton-upon-Humber

G&W News

The latest news

Up to date news from G&W UK, Freightliner & Pentalver.